McDermott+ is pleased to bring you Regs & Eggs, a weekly Regulatory Affairs blog by Jeffrey Davis. Click here to subscribe to future blog posts.

July 2, 2025 – There has been a lot of talk recently about the future of the Medicare Physician Fee Schedule (PFS) conversion factor (CF) – the standardized dollar amount used to convert relative value units (RVUs) into payment rates. The CF plays a central role in determining how physicians are reimbursed under Medicare, and it’s come under increased pressure in recent years. Despite rising practice costs and broader inflationary trends, the CF has been cut for the last five years because of various policy and budgetary factors. My colleagues and I provided an overview of this ongoing CF “saga” during our recent PFS Preview webinar, but there have been several important developments since then (mostly notably the Senate bill that just passed includes a temporary, one-year bump to the PFS CF).

To discuss the what’s changed and what could happen next, I’m bringing in my colleague Rachel Hollander.

Before diving into the latest news on the PFS CF, let’s provide some context and history (we know there is a lot of history here, so we hope you are history buffs!). Let’s start with the simple question of how we got into a situation where there have been actual reductions to the CF for the last five calendar years (CYs).

The Centers for Medicare & Medicaid Services (CMS) establishes the final PFS CF in the annual PFS final rule, but Congress can, and has, adjusted the final PFS CF after the final rule is released. CMS is required to factor in certain inputs when determining the final PFS CF for a given year, and three inputs in particular have contributed to the CF cuts:

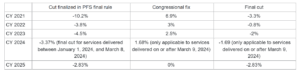

Each of these three factors has contributed to the year-over-year reductions to the CF, as can be seen in year-by-year “history lesson” below. The 0% annual update from MACRA from 2020 through 2025 stagnated the growth of the PFS CF, allowing the other two contributing factors to weigh down the PFS CF.

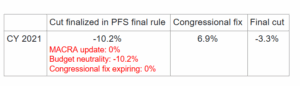

CY 2021

The recent cuts to the PFS CF began in the CY 2021 final rule, when CMS increased payment for office/outpatient evaluation and management (E/M) services and introduced add-on code G2211. To maintain budget neutrality, CMS reduced the CF by 10.2%. With MACRA’s 0% update, there was no automatic offset, leaving Congress as the only avenue for relief. The Consolidated Appropriations Act, 2021, enacted on December 27, 2020, included a one-time 3.75% fix and delayed implementation of G2211 to CY 2024, effectively restoring 3.1% to the CF. These actions reduced the total cut from 10.2% to “only” 3.3% in CY 2021.

Because the 3.75% fix applied only to CY 2021, the full cut was set to return in CY 2022 unless Congress intervened again. The delayed implementation of G2211 also was not a permanent solution – when the moratorium expired and the code became payable in CY 2024, it triggered another 2% cut to the CF to preserve budget neutrality.

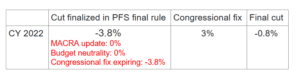

CY 2022

The 3.75% fix expired in CY 2022, setting up yet another cut unless Congress stepped in again. Congress intervened and offset 3% of the cut in the Protecting Medicare and American Farmers from Sequester Cuts Act, enacted December 10, 2021, resulting in a net 0.8% reduction to the CF for CY 2022.

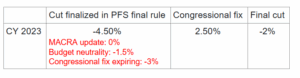

CY 2023

The CF once again faced a 3% cut as the prior year’s fix expired. On top of that, CMS finalized other policy changes (again, primarily related to E/M coding) that increased overall PFS spending, triggering an additional 1.5% reduction to maintain budget neutrality and bringing the total cut to 4.5%. Congress included a partial two-year fix in the Consolidated Appropriations Act, 2023, enacted on December 29, 2022. The fix included a 2.5% adjustment for CY 2023 (reducing the net CF cut to 2%) and a 1.25% fix for CY 2024. That additional 1.25% was intended to ease the transition from CY 2023 to CY 2024.

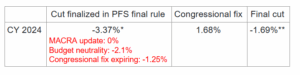

CY 2024

The CF once again faced a reduction as the latest temporary fix expired. The 1.25% fix included in the Consolidated Appropriations Act, 2023, applied only to CY 2024, leaving the remaining 1.25% of the prior year’s projected cut in place. CMS also finalized the long-delayed implementation of add-on code G2211. When G2211 became payable in 2024, it triggered a new budget neutrality cut of approximately 2%, reflecting updated assumptions about how frequently the code would be used. Although those revised assumptions were lower than the 2021 estimates, they still proved significantly higher than actual utilization in 2024, as highlighted in a recent blog post.

Altogether, the CF was set to be reduced by 3.37% in CY 2024 – 1.25% from the expiring fix and roughly 2.1% due to implementation of G2211 and other policy changes. Congress again stepped in. The Consolidated Appropriations Act, 2024, enacted on March 9, 2024, provided an additional 1.68% in relief, supplementing the 1.25% enacted the prior year. In total, Congress offset 2.93% of the cut. However, the new relief was not retroactive. The full 3.37% cut went into effect on January 1, 2024, and remained in place until March 8, 2024. The fix took effect March 9, 2024, reducing the cut to 1.69% for the remainder of the year.

* Final cut for services delivered between January 1, 2024, and March 8, 2024.

** Reduced cut for services delivered on or after March 9, 2024.

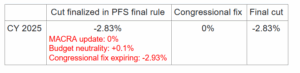

CY 2025

Stakeholders anticipated another 2.93% cut as the combined fix for CY 2024 expired. However, in a rare shift, CMS finalized policies that resulted in a positive 0.1% budget neutrality adjustment. While welcome after four consecutive years of negative adjustments, the minimal change did little to offset the broader impact. Clinicians still face a 2.83% cut to the CF in CY 2025, and so far, Congress has not taken action to prevent it.

Understanding that the history lesson was anything but simple (or short), here is a breakout of the cuts from the last five years:

Now that we know the history, let’s assess the recent proposals to address the problem.

Although three distinct factors have contributed to the cuts over the last five years, recent discussions have only addressed the first factor: the updates established by MACRA.

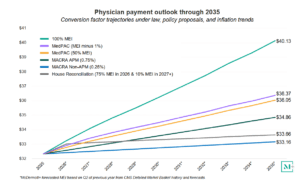

As noted, beginning in CY 2026, the CF will once again receive positive annual updates under MACRA: 0.75% for QPs and 0.25% for all other clinicians. While these updates will continue indefinitely, they are modest and unlikely to keep pace with inflation. In response, policymakers and stakeholders have proposed tying future CF updates to the Medicare Economic Index (MEI), an inflation-based index commonly associated with physician payments. Both Congress and the Medicare Payment Advisory Committee (MedPAC) recently advanced proposals incorporating variations on an MEI-based update structure.

Option 1: As part of the budget reconciliation process, the US House of Representatives passed H.R.1, the One Big Beautiful Bill Act, on May 22, 2025. The bill included a provision that would eliminate the current two-tiered CF update structure and replace it with a single annual CF update. The bill would have increased the CF by 75% of MEI in CY 2026 and 10% of MEI in CY 2027 and beyond. The House bill also would not have adjusted the CY 2025 CF, allowing the 2.83% cut to continue.

Option 2: On June 12, 2025, MedPAC released its Report to the Congress, which included a recommendation to update the CF by MEI minus 1%. MedPAC has floated several MEI proposals in recent years, including updating the CF by 50% of MEI in its March 2024 report to Congress.

Option 3: The US Senate initially released reconciliation text in mid-June that did not include any fix for the PFS CF for CY 2026 or future years. However, revised Senate text released on June 28, 2025—and passed by the Senate on July 1, 2025—includes a 2.5% one-year patch for CY 2026. Like previous short-term fixes, the provision would expire at the end of CY 2026. As a result, unless Congress acted again, CMS would be required to remove the adjustment from the CF for CY 2027.

The chart below shows how various policy proposals would affect the Medicare PFS CF through 2035, including an illustrative scenario based on 100% of MEI – although no stakeholder has formally proposed that approach – with MEI-based updates generally resulting in significantly higher CF growth than current law. Since option 3 from above, the 2.5% fix for CY 2026, expires at the end of one year, it does not change the 10-year CF trajectory compared to current law. Thus, that option is not reflected in the chart—although at this point, it may be the option that has the greatest chance of being fully adopted in the short term.

One major caveat to the chart above is that the CF amounts assume that no budget neutrality adjustments or congressional fixes will need to be factored into the final CF calculations. As you now know, the budget neutrality requirement has been a significant contributor to the recent PFS cuts, leading Congress to step in and provide temporary fixes. Going forward, if CMS finalized a policy that triggered a significant budget neutrality adjustment (as it did in CY 2021), an otherwise small positive CF annual update could turn negative absent intervention from Congress. In other words, modest updates to the CF on their own are unlikely to stabilize physician payments, given the cumulative impact of inflation, budget neutrality cuts, and other downward pressures.

Several legislative proposals in recent years have aimed to address budget neutrality and other underlying challenges affecting physician payment under the PFS. For example, H.R. 6371, the Provider Reimbursement Stability Act, introduced in 2023, would:

While these proposals reflect a more comprehensive approach to addressing the range of issues affecting physician payments, they have not been introduced in the current Congress and are not actively under consideration.

Although H.R.1 included a long-term physician payment reform proposal, the Senate bill only includes a temporary update. If the Senate provision is the one that ultimately gets across the finish line, we’ll likely be back at the drawing board come CY 2027, when physicians could be facing another cut and asking Congress for another short- or long-term fix. As it stands today, it looks like any ideas for permanently reforming the PFS may be pushed off to another day.

Even if a permanent reform is implemented (eventually) that ties the PFS CF to the MEI, such a policy would address only one of the major issues facing the PFS. An MEI-based policy could help establish a more predictable and structured framework for updating Medicare physician payments, and help bring the PFS more in line with other Medicare payment systems that receive automatic inflationary adjustments. But without additional reforms – particularly to address the $20 million budget neutrality threshold that has remained unchanged since 1992 – stakeholders have expressed concern that the ability of an MEI-based policy to provide long-term stability to physician payments may be limited.

Until next week, this is Jeffrey (and Rachel) saying, enjoy reading regs with your eggs.

For more information, please contact Jeffrey Davis. To subscribe to Regs & Eggs, please CLICK HERE.