McDermott+ is pleased to bring you Regs & Eggs, a weekly Regulatory Affairs blog by Jeffrey Davis. Click here to subscribe to future blog posts.

May 22, 2025 – It’s getting hot outside, which means that the summer regulatory season is almost upon us. In June or July, the Centers for Medicare & Medicaid Services (CMS) will release proposed regs impacting Medicare payments in calendar year (CY) 2026, including the CY 2026 Physician Fee Schedule (PFS) proposed rule. The PFS is the major annual reg that impacts Medicare payments for physicians and other healthcare practitioners in the next calendar year. Many private payers revise their reimbursement levels based on the PFS rates, so the reg has relevance beyond just Medicare. The reg also includes updates to the Quality Payment Program, the performance program established by the Medicare Access and CHIP Reauthorization Act (MACRA).

Once CMS releases the PFS proposed reg, there is a 60-day public comment period where different stakeholders, including many of you, will provide feedback on the proposed policies. Trust me, in the thick of the summer, that time flies by, and it is essential to be as prepared as possible entering that period. And that’s what we at McDermott+ are here for. Next Wednesday, May 28, 2025, at 3:00 pm EDT, my colleagues and I will host a webinar to preview the PFS proposed reg. Although we don’t know exactly what the reg will include, we will provide political context for the PFS (in case you didn’t realize, there is a lot of healthcare action happening in Congress right now) and discuss potential issues that CMS could focus on in the reg. You can register for the webinar here.

To help provide a preview of the webinar (i.e., a preview of the PFS preview), I’m bringing in my colleagues Rachel Hollander and Yamini Kalidindi. The proposed reg will include some big-ticket items of interest to healthcare stakeholders, and without giving everything away (you have to attend the webinar for that!), we can offer context on some of the most closely watched items – starting with the conversion factor (CF).

The CF is the standardized dollar amount used to convert relative value units (RVUs) into payment rates. It plays a central role in determining how physicians are reimbursed under Medicare, and it’s been under growing pressure in recent years. Because of statutory budget neutrality requirements and the absence of any automatic positive payment updates since 2019 (MACRA established a 0% update from 2020 to 2025), the CF has steadily declined even as practice costs have risen. The 2025 CF is approximately $32.34 – a 2.83% cut from 2024. For those of you counting, this represents the fifth consecutive year of reductions, and Congress has yet to mitigate the 2025 cut (unlike previous years). In 2026, clinicians are scheduled to receive a small update under MACRA. The law provides for two separate annual updates beginning in 2026: a 0.75% increase for clinicians in Advanced Alternative Payment Models (APMs) and a 0.25% increase for all others. These modest increases are unlikely to keep pace with inflation, prompting renewed calls for reform.

Congress is currently considering such reform. As part of the budget reconciliation process, the US House of Representatives Energy and Commerce Committee advanced a proposal that would eliminate the current law’s two-tiered CF update structure and replace it with a single annual CF update tied to the Medicare Economic Index (MEI), a measure of practice cost inflation. The bill proposes to increase the CF by 75% of MEI in 2026 and 10% of MEI in 2027 and beyond. This proposal would provide something physicians have long called for and something most other Medicare payment systems already have: an automatic inflation-based update. Still, the long-term impact would hinge on how the MEI trends over time and whether Congress addresses broader structural issues with the PFS – most notably, the $20 million budget neutrality threshold, which hasn’t been updated since 1992 and continues to be a major barrier to stabilizing physician payment rates.

Under the budget neutrality requirement, CMS must ensure that any changes it makes to specific PFS codes will not result in an increase or decrease in PFS spending of more than $20 million. The low threshold of $20 million is easily surpassed each year, so CMS always makes an overall adjustment (usually negative) to the CF to preserve budget neutrality. The more spending that CMS assumes will result from the RVU changes, the larger the adjustment CMS must make to the CF. Therefore, we always watch PFS regs for new codes or other policies that will cause a large increase in projected spending. “Projected” is the operative word here, as sometimes CMS’s projections (which, again, CMS uses to inform the size of the budget neutrality adjustment to the CF) do not come to fruition.

And that brings us to one of the most closely watched items in this year’s PFS: utilization of HCPCS code G2211, the add-on code for visit complexity that became effective January 1, 2024.

You might be wondering, why are we talking about a 2024 code in a preview of 2026 policy? The answer is simple: data. The CY 2026 PFS proposed reg will be the first time CMS publishes utilization data for G2211, one of the most debated policies of the 2024 rulemaking cycle. The controversy centered on CMS’s assumption that G2211 would be billed with 38% of all evaluation and management (E/M) visits in 2024 – a sizable projection, especially given that E/M services are among the most commonly billed services under Medicare. Because of those pesky budget neutrality requirements mentioned above, CMS had to offset the projected cost of G2211 by applying a 2.18% across-the-board cut to the 2024 CF. According to CMS, roughly 90% of that reduction was attributable to G2211.

Many stakeholders pushed back, arguing that CMS significantly overestimated the code’s likely use. That’s important – even for physicians eligible to report G2211, if actual utilization fell short of CMS’s assumptions, the resulting CF cut could outweigh any benefit they’d receive from billing the new code.

So, the big question is: was CMS right? Did G2211 show up on 38% of all E/M claims in 2024?

The good news is you don’t have to wait until July to find out. We’ll do a deep dive on G2211 utilization during our May 28 webinar, looking at the data by specialty, site of service, diagnoses, and more. We’ll also help you understand how that data fits into the broader policy context, especially as Congress debates future CF updates and broader reforms to the physician payment system.

But to hold you over until then, we’re offering an early look at the data today. We’re not revealing raw figures yet – that’s for the webinar – but we are sharing some initial insights on how G2211 was reported in 2024, broken down by type (new versus established patients) and level (1 through 5) of E/M visits.

First, G2211 is an add-on code, meaning it must always be reported alongside a base E/M service. One of stakeholders’ key questions (beyond the accuracy of the utilization estimates) was whether G2211 was even necessary, particularly following the recent overhaul of the E/M code set, which aimed to give physicians a more precise and flexible framework for billing based on time or visit complexity.

Critics questioned, for example, why G2211 would be necessary for a level 1 established patient visit – couldn’t a level 2 code more accurately reflect the time and/or complexity instead?

We’re not here to weigh in on that debate. Instead, let’s look at what actually happened.

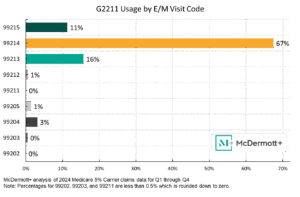

We dug into the newly available 2024 Medicare 5% Carrier claims data for Q1 through Q4 2024, and here’s what stood out: G2211 was most commonly billed with CPT code 99214, accounting for nearly 67% of all G2211 use. Add in 99213 (16%) and 99215 (11%), and you’ve got more than 94% of G2211 claims tied to moderate- to high-level established patient visits.

On the flip side, G2211 was almost never billed with new patient visits and/or lower-level codes. That gives us an early signal that the code is generally being used as intended: to support relationship-based care for patients with more complex or ongoing needs, not for routine or quick visits.

But what about CMS’s 38% estimate? Did G2211 show up on that share of E/M claims?

In short: not even close. For example, only about 15% of all 99214 claims (the E/M code most frequently reported with G2211) billed in 2024 included the add-on code.

This is just one of the many issues in the PFS. There’s plenty more to come on both the data and policy analysis fronts, not only for G2211, but across a range of topics we’ll cover during the webinar, including those likely to emerge as priorities for the second Trump administration. That includes elements of the “Make America Healthy Again” agenda – such as chronic disease management – and the expanding role of digital health, remote monitoring, artificial intelligence, and other innovations. We’ll look at how CMS may approach payment for these technologies and how they fit within the Quality Payment Program and broader value-based care efforts.

It’ll be a fast-paced, insight-packed session – full of data, policy updates, and practical takeaways to keep you well informed and ahead of the curve as the 2026 rulemaking season kicks off. You won’t want to miss it!

Until next week, this is Jeffrey (and Rachel and Yamini) saying, enjoy reading regs with your eggs.

For more information, please contact Jeffrey Davis. To subscribe to Regs & Eggs, please CLICK HERE.